Hong Kong Options trading has grown substantially over the past several years, especially after Hong Kong was named one of the three core centres for global derivatives trading by the Bank for International Settlements in 2011.

Trading volume for options contracts has grown so much that it now accounts for 12% of all derivatives traded globally, with most activity occurring in Asia. For traders looking to trade options, there are many choices available.

What are iron condors?

Iron Condors is a day trading strategy that takes advantage of time decay. The trader does not have to be as precise with predicting the underlying market as is necessary with other strategies.

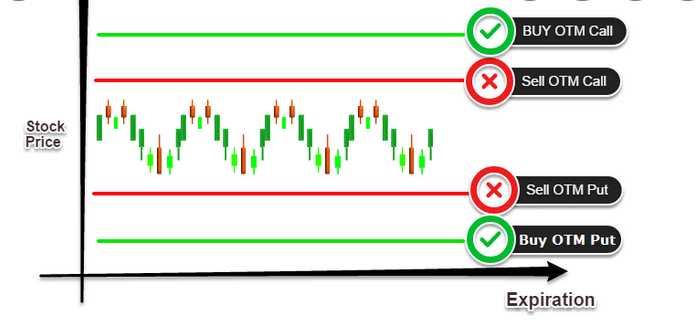

When using this strategy, you buy and sell four options at the same strike price, defined by your entry point. You also establish two credit spreads at different strikes below and above your entry point. These are used as protective orders to ensure that if the trade goes against you, you can cut losses quickly before they get large.

The trader will exit these positions when one has reached its expiration date or expired worthless because prices have moved past your original sold strike. Still, it returns less than your initial investment after subtracting commissions from the trade.

Iron condors are low risk/high reward options trading strategies that you can implement with an index or individual stock options. They may be part of a larger strategy like the 40 Acton (40 Act) Strategy, also known as option straddles in some circles.

Trading iron condor options in Hong Kong

Iron condors are very popular among Hong Kong traders, and it’s not difficult to understand why. They provide consistent returns regardless of how markets are moving, all while ensuring that there is no more than a limited risk involved at any given time during the life cycle of each traded contract. This makes them ideal for newer options traders with little experience or even veteran traders looking for low-stress trading opportunities.

Hong Kong offers many different trading platforms for traders to choose from, along with an exceptional level of customer service. Users are free to choose the platform that’s right for them, whether they’re using traditional desktop platforms or newer software-based platforms that you can access via mobile devices. The biggest challenge will likely be determining which brokers offer the best pricing and services since there are so many available options. Each trader will have their preferred broker based on their specific needs, but it’s safe to say that Hong Kong brokers are top-notch no matter which one you ultimately wind up choosing.

If you live in Hong Kong or plan to travel there soon, consider talking to several brokers to see what they offer and compare their services with those from brokers elsewhere. This is important since the most expensive broker isn’t necessarily the best one for you.

Depending on these factors, an options trader can set up his trade at the right time for maximum profit. It is essential to know how much he has to pay for the premium and collect a sufficient premium to make it worthwhile. Otherwise, there’s no point in entering the trade because getting out for less than he paid means that he loses money, having no income from other trades. So it is wise not to choose something too low risk because there are chances that he might get stopped out. An alternative would be to use a stop loss at a dangerous area where it’s likely that others may have entered into short positions as well.

Summary

Iron Condors have become a popular options strategy because they are so safe. You can’t lose more than your maximum loss, no matter how poorly your trade performs. If you want to trade in options and need strategy advice, contact a reputable online broker from Saxo Bank, and start trading on a demo account.