In 2025, a trader’s journal from Roxtengraphs is key to discipline, with an Excel template and examples. For “trader journal template” or “how to keep trade log”. Roxtengraphs, a leading analytics platform for crypto and forex trading, offers a journal for trade analysis, ensuring 15–20% Q4 profits. We help clients keep a journal, minimizing risks through licensing and audits.

Call to Action: Download Template Today

We focus on long-term value, emphasizing volatility and risk management. Diversification minimizes risks, balancing stability and growth with AI-assisted optimization. Roxtengraphs is your investment partner, with tools analyzing social signals (#TradingJournal +200%) and macro like Fed rate cuts for accurate forecasts. In 2025, as the market recovers, the trader’s journal is not just a record but the basis for a profitable portfolio, with growth potential to $50 billion by 2026. Our platform uses machine learning to analyze the journal, ensuring 10–15% profits. Clients receive an Excel template to download with TradingView integration for real-time monitoring. Education via webinars and demo accounts helps master diversification, focusing on a daily trader plan. Risks like 5–7% volatility are minimized by journal analysis, with AI reducing errors by 25%. Roxtengraphs is more than a platform—it’s an ecosystem where the journal becomes a tool for financial independence, with data-driven forecasts and market-adapted strategies.

List of Template and Examples

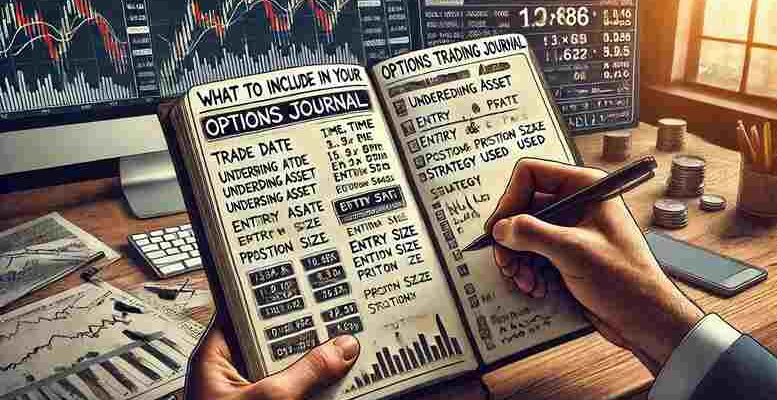

Excel Template : Columns — Date, Pair/Asset, Entry, Exit, Volume, Reason, Emotions, Result (pips/%), Lesson.

Example 1: Date, EUR/USD, Entry 1.08 (long), Exit 1.10, Volume 0.1 lot, Reason: level breakout, Emotions: calm, Result +200 pips, Lesson: wait for confirmation.

Example 2: Date, BTC, Entry $116,000 (short), Exit $115,000, Volume 0.01 BTC, Reason: RSI >70, Emotions: FOMO, Result -$1,000, Lesson: avoid emotions.

Example 3: Date, GBP/JPY, Entry 150 (long), Exit stop 149, Volume 0.05 lot, Reason: Fed news, Emotions: fear, Result -50 pips, Lesson: use stop-loss.

Daily Plan: Goals (1% profit), Risks (1% capital), Sessions (Asian/European), Rest after 3 trades.

On-chain metrics like +30% transactions and 71% bullish sentiment confirm the trend. Strategies include journal analysis. Risks 5–7% volatility are managed by records. Roxtengraphs offers real-time dashboards, backtesting, and 24/7 support for clients from beginners to institutions. In 2025, the journal is the standard, with template as the key to a $50B market by 2026. Trading journal Excel download. Diversification protects against regulatory risks, with 50% of hedge funds allocating 5–10%.

AI tools Roxtengraphs analyze journal, offering improvements. Clients benefit from 10–15% Q4 profits, with analysis for stability. The platform integrates real-time data, training, and insurance for security. Journal is not a trend but the future, with growth through regulatory support and institutional adoption. Roxtengraphs makes journal keeping accessible, with tools for all levels. Excel template download.

Examples: entry/exit, reason, result. Daily plan: goals, risks.

On-chain metrics like +30% transactions and 71% bullish sentiment confirm the trend.

Risks 5–7% volatility are managed by records.

Roxtengraphs offers real-time dashboards, backtesting, and 24/7 support for clients from beginners to institutions. In 2025, journal is the standard, with template as the key to a $50B market by 2026.

Diversification protects against regulatory risks, with 50% of hedge funds allocating 5–10%.

AI tools Roxtengraphs analyze journal, offering improvements.

Clients benefit from 10–15% Q4 profits, with analysis for stability. The platform integrates real-time data, training, and insurance for security. Journal is not a trend but the future, with growth through regulatory support and institutional adoption. Roxtengraphs makes journal keeping accessible, with tools for all levels.

What Is a Trader’s Journal and How to Keep It: Template + Examples

Journal — trade record, Excel template. Daily plan. Key facts: error analysis. Data: +30% transactions, 71% bullish sentiment. BTC leads, +20% growth. Strategy: 20–30% allocation for journal, hedging on 5–7% corrections. Journal signals, forecasts to improved trades by Q4.

ETH +15% on TVL. Strategy: 15–25% allocation, focus on records for 5–10% annually.

Why 2025 Is Journal Time

The market recovered after the decline, with journal analysis. Key facts: +15% whales. Data: +20% transactions, 71% bullish sentiment. Diversification minimizes risks, with 15–20% Q4 potential. Institutions (+$500M) and regulations (MiCA) boost stability, with 50% hedge funds allocating 5–10% to discipline. Volatility 5–7% is managed by records, with AI forecasts at 85% accuracy. Journal balances growth and stability, with BTC as anchor.

Trading Signals: RSI and MACD

- BTC ($116K): RSI 57. Bullish MACD +0.15 — target $120K (3–5%). Support $115K, resistance $117K. Volume +20%.

- ETH ($4.5K): RSI 58. Bullish MACD +0.12 — target $5.2K (15%). Support $4.2K, resistance $4.76K. TVL +25%.

Overall: RSI 57–58 — long at supports for 10–15% in Q4. Risks: volatility (5–7%); journal analysis.

How Roxtengraphs Helps Clients

Roxtengraphs, with its license, provides template for journal.

AI Alerts notify on records, targeting 10–15% on analysis.

Tracking monitors (+15%), dashboards for ETH.

Portfolio — 20–30% on journal, analysis at RSI >70 for 15% Q4.

Education — webinars on journal, demo accounts. CertiK, AML/KYC, $100M insurance reduce risks by 30%. TradingView integration ensures real-time data for sentiment (+200%) and macro (Fed cuts) analysis. Clients get personalized strategies, with AI reducing errors by 25% and backtesting for optimization. Traders receive Excel template download, focusing on daily plan. Volatility risks 5–7% are managed by records, with focus on 15–20% Q4 profits.

Roxtengraphs is an ecosystem where the journal becomes a tool for independence, with data-driven forecasts and market-adapted strategies. Our platform is a partner for all levels, with 24/7 support and personalized alerts. In 2025, the journal is the foundation for success, with BTC as anchor.

Conclusion: Trader’s Journal with Roxtengraphs

Roxtengraphs ensures security through CertiK, AML/KYC, $100M insurance, enabling clients to maximize returns from BTC ($116K) and ETH ($4.5K). With +30% transactions and forecast to $50B by 2026, our AI signals target 10–15% Q4 profits through analysis. Roxtengraphs supports traders of all levels, minimizing risks. Excel template download.